If you’re reading this, it’s safe to assume that you’ve come to learn about the most talked-about financial invention in recent years cryptocurrencies, particularly bitcoin.

Let’s look at what bitcoin is and why it’s getting so much attention. Not only on social media and in online forums, but also in central banks, special committees, and governments around the world.

It is quite simple to become a member of the community and begin utilizing the new digital currency.

The phrase “cryptocurrency” is a literal translation of the English term “cryptocurrency,” which refers to a virtual currency protected by encryption. To begin with, cryptocurrency is a fast and secure payment and money transfer system built on cutting-edge technologies that is independent of any authority.

bitcoin, btc

The word “Bitcoin” is formed in English from “bit” – the minimum unit of information and “coin” – a coin. Following the rules of English-Russian transcription , this term must be translated into Russian as “Bitcoin” .

This spelling is used by the official website bitcoin.org , Bitcoin Wiki Wikipedia , Central Bank of the Russian Federation and other resources. The hitherto widely accepted variant ” Bitcoin ” originated from the first translation of the wallet interface based on direct transliteration.

The most common abbreviation for Bitcoin – BTC – is usually used in stock trading and financial articles. The Cyrillic abbreviation, BTK , did not catch on in the community.

What is Bitcoin? This is the first and most famous of the many cryptocurrencies , the symbol and flagship of the cryptocurrency world, as well as the monetary unit of the same name that circulates within the system. Later in this article, we will explain how the cryptocurrency works, using the example of Bitcoin.

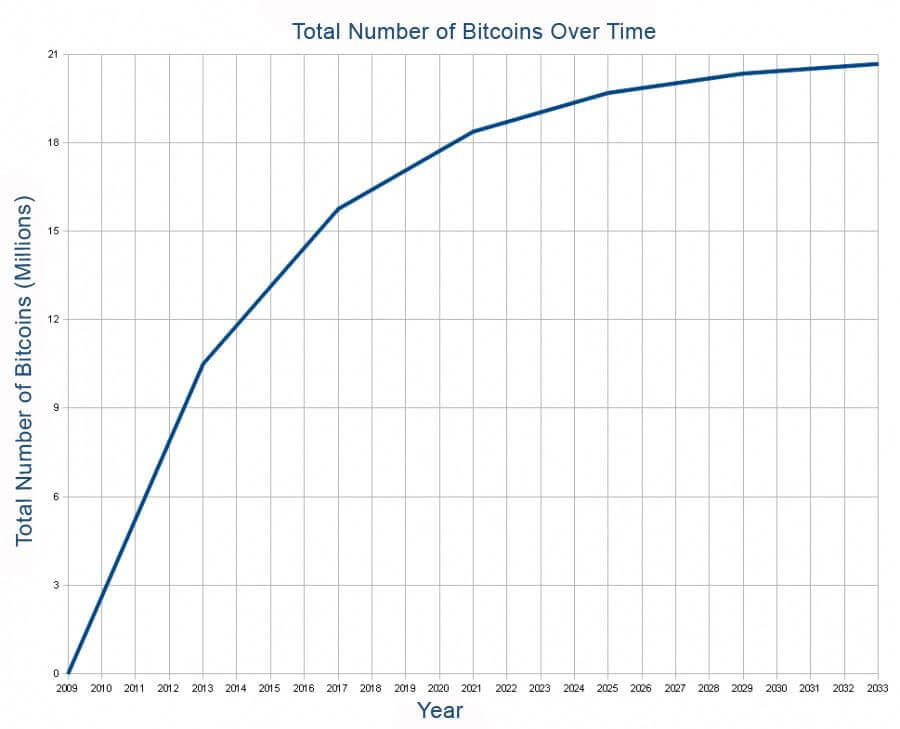

In terms of economics, what is the most important attribute of Bitcoin? It is a limited-supply digital commodity with an algorithm that allows for a maximum of 21 million units to exist in the system, each of which is also known as “bitcoin.”

The emission schedule is predetermined and known ahead of time. The number of coins generated after the last one is generated will not vary.

Many economists are concerned about the Bitcoin economy since it is based on a deflationary concept. They do not, however, discover any practical justification.

In fact, because 1 bitcoin is divided into 100,000,000 parts, which are termed “satoshi” in honor of the system’s creator, such a modest amount of coins is sufficient for everyday computations. The words “millibitcoin” (mBTC) and “microbitcoin” (uBTC) are sometimes used interchangeably.

On October 31, 2008, a mysterious figure working under the pseudonym Satoshi Nakamoto published a concept paper that launched Bitcoin. Despite countless journalistic inquiries, the identity of the true developer, whether it is a single person or a group, remains unknown. The practical implementation of this concept in the program code begins on January 3, 2009. The first block in the network, the so-called genesis block, was generated at 18:45 GMT (22:45 Moscow time) on March 1, 2009. This day is known as Bitcoin’s birthday, and it is commemorated by the Bitcoin community all over the world.

What is the difference?

Bitcoin has characteristics that set it apart from other forms of electronic and paper money:

Accessibility and decentralization : The Bitcoin network is made up of all client programs (wallets) and a distributed blockchain database (blockchain, block chain) that is saved on any machine running the complete client. Blockchain is a public ledger of all system operations that can be viewed by anybody. Without passwords or other authorisation, you can connect to this registry using your own wallet or a web interface of special monitoring services from anywhere in the globe.

Full transparency of calculations : Any payment’s history can be tracked back to the minute the coins are created (theoretically), and it will never be removed from the database. You may find all any transactions accepted by or sent from this Bitcoin address at any time by knowing simply the Bitcoin address.

Free choice of degree of participation : The official Bitcoin Core client, which keeps the whole transaction history, can be downloaded. If you don’t need offline work or blockchain analysis, you can use one of the light or mobile wallets, which use a lot less power. A mobile or online wallet will suffice if you simply intend to pay for modest items on the go or to experiment with technology. Hardware wallets with additional levels of security are available for optimum security.

Lack of network control : The Bitcoin network does not have a controlling center that can freeze any account, adjust the quantity of monetary units in the system, block or cancel a payment because the blockchain is a distributed base formed on the foundation of peer-to-peer nodes. Small commissions are charged, the amount of which is essentially undetectable in practice and is independent of the amount transferred. In the same manner that currency transactions are irreversible, system transactions are as well.

Possibility of anonymous payments : Bitcoin is a handy and, if wanted, anonymous method of payment in which the address – the system’s account number – is not linked to the owner and no documents are necessary to open an account. This is a 34-character string made up of numerals and letters from the Latin alphabet in various cases. 1BQ9qza7fn9snSCyJQB3ZcN46biBtkt4ee is an example of an address: 1BQ9qza7fn9snSCyJQB3ZcN46biBtkt4ee. For ease of calculation, it can be turned into a QR code or other two-dimensional code, or it can be transferred as is.

Award for Network Support : New bitcoins are created as a reward for people who do computational tasks that assure transaction transmission. The term “mining” comes from the English word “mining,” which means “to mine.” “Miners” are the people who perform these calculations. Their mission is to compile all network transactions since the previous block’s release (on average 10 minutes) into a single block and “seal” it with a sophisticated cryptographic signature. The signature of the previous block is used to calculate the following block, ensuring transaction irreversibility and preventing “fake” currencies from entering the system. As a result, the blocks interlock, producing a chain known as blockchain.

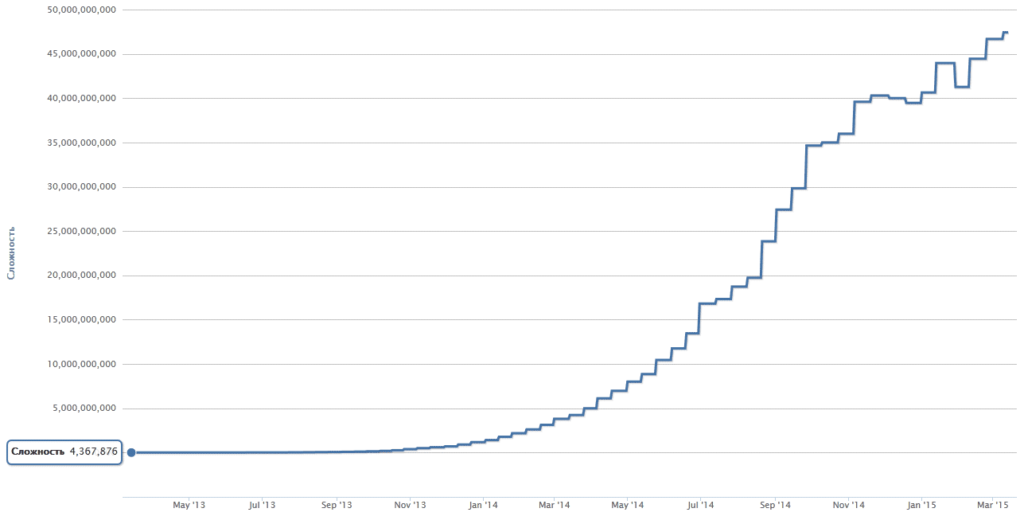

Unsurpassed protection : Miners need more computational power to calculate the entire chain from begin with each new block, and the longer the chain is, the more difficult it is to “hack” the network. Bitcoin is now a decentralized computing network with a performance that is more than 8 times faster than the total computing power of all supercomputers on the planet (in terms of calculating SHA-256 hashes). Hundreds of millions of dollars in resources and expenditures are required to gain even modest control over it.

Cryptocurrencies in life

Bitcoins were first only sought after by mathematicians, cryptographers, and others with a strong interest in computer and network technologies. At the time, bitcoins were merely proof that electronic money could exist without a secure underpinning. Rather, they can be compared to an electronic version of gold since, like gold, bitcoin is difficult to mine, has a finite supply, and the difficulty of mining only grows with time.

1 BTC could already be purchased for 0.8 cents in autumn 2009. Since then, the history of exchange trading has seen numerous ups and downs, as well as high-profile bankruptcies and successful enterprises. At initially, bitcoin transactions were infrequent and episodic. The first and most notable was the purchase of two pizzas for 10,000 BTC in May 2010 (the equivalent of $ 25 at the time). The exchange rate has surged to $1,000 and then fallen back to $150 since then, but that’s another story…

The Japanese exchange MtGox and the criminal online bazaar Silk Road helped to popularize Bitcoin at an early stage in its development. Bitcoin is no longer reliant on a single exchange or pool, and law enforcement agents have learnt to treat criminal cryptocurrency activity in the same way they do other economic crimes.

Bitcoin is now a modern digital money that is ideal for online transactions. More and more businesses are accepting Bitcoin as a form of payment. The ease with which people in poor countries can register a Bitcoin account is luring a growing number of people to this digital currency. The Bitcoin network has replaced hard-to-reach and expensive banking services for citizens in several Asian and African countries. POS terminals for bitcoin payments in establishments, cryptocurrency ATMs, and Bitcoin hardware wallets have all become commonplace in industrialized countries. There has been a significant increase in the number of startups that employ Bitcoin. Blockchain technology has proven to be suitable not just for financial settlements, but also for distributed data storage on numerous assets. Thousands of different cryptocurrencies have already been established based on Bitcoin or from scratch.

A little about politics

States have vastly differing perspectives on cryptocurrency. Both obvious encouragement – in Japan, Australia, Germany, the Netherlands, New Zealand, Singapore, some US states, and other offshore corporations – and substantial restrictions that can outgrow and prohibitive measures – in Indonesia, China, Russia, and Ukraine. Only the most committed Latinos in Bolivia and Ecuador voted for total bans.

Many governments, including the majority of the EU, the United Kingdom, and Switzerland, as well as the federal government of the United States, Canada, and Southeast Asian countries, have chosen the line of sight with cautious hope. Financial regulation is being adapted in most developed nations to control cryptocurrencies, and this issue will be handled shortly.

Read More :

- BitRiver and Gazprom Neft Have Partnered to Mine Cryptocurrencies using related gas

- The Fed’s Actions Will Determine Whether the Bitcoin Market Recovers, Says Michael Novogratz

- Staking Platform Finblox iNtroduced a Monthly Withdrawal Limit

- Babel Finance, a Cryptocurrency Lending Platform, Has Suspended Withdrawals